Displaying items by tag: ban

ASA bans burning banknotes ads from SIPP provider

The Advertising Standards Authority has banned several advertisements for investment platform and SIPP provider Wahed Invest which showed US and Euro banknotes on fire.

FCA bans adviser duo for pension transfer failings

The Financial Conduct Authority has banned Steven Hodgson and Paul Adams of Stockton-on-Tees-based Vintage Investment Services from advising customers on pension transfers and opt-outs.

FCA plans to ban 2 over £10m of SIPP investments

The FCA has provisionally banned two financial advisers for “acting without integrity” in relation to SIPPs pensions advice involving £10m of investments.

Two pension transfer advisers face £1.3m in FCA fines

The Financial Conduct Authority plans to fine company directors Toni Fox £681,536 and David Price £632,594 over their roles in £392m of mostly "flawed" pensions transfers.

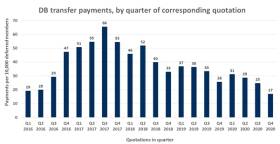

Contingent charge ban cuts pension transfers

The ban on contingent charging and the pandemic have resulted in a major slump in pension transfers, according to new research.

FCA drops move to ban platform exit fees

The FCA has abandoned plans to ban platform exit fees.

In a regulatory update today the watchdog said the move was no longer necessary as a number of platforms had dropped exit fees after the regulator highlighted the issue.

The FCA criticised exit fees as a barrier to investors moving platforms.

The FCA’s Investment Platforms Market study (2018/19) found that while the platform market “works well overall, there were areas where it could work better.”

One of the areas highlighted was the barrier to moving platforms created by exit fees levied by a number of platforms.

The FCA said in Policy Statement 19/29 it would consult on restricting platform exit fees in Q1 2020.

Due to the Coronavirus pandemic the FCA then delayed the move to Spring 2021.

It now says: “We have now decided to stop work on this consultation.

“Since expressing our concerns in the 2018 Interim Report, there has been a marked shift in the market away from exit fees, with at least two major platforms announcing that they would no longer be charging exit fees.

“The FCA welcomes the direction of travel by the investment platforms sector in phasing out the use of exit fees.”

The regulator added that while it has dropped the Exit Fees Consultation it will be closely monitoring the situation and has hinted it will shake up the sector if new barriers to moving platform or any other consumer detriment emerges.

The move to drop an exit fee ban has been criticised by some.

Richard Wilson, chief executive of interactive investor, said: “We are saddened to see this news snuck out on the afternoon of Friday 13th. Exit fees are a recipe for rip offs and a genuine barrier to consumers seeking better value for money - they should have been banned.

“The FCA rightly points out that the direction of travel in the industry has been away from exit fees, in large part because interactive investor and Hargreaves Lansdown have done away with them. But there are still platforms out there that have grown far too complacent, relying on customer inertia and hefty penalties."

“There is no reason to turn off the heat - quite the opposite. Scrutiny on exit fees needs to be extended to life companies, asset and wealth managers, life insurers and beyond. We are completely bewildered by the FCA’s announcement and today is a sad day for consumers.”

FCA to ban most DB transfer contingent charging

The Financial Conduct Authority says it will ban most contingent charging on DB pension transfers as part of a raft of measures designed to tackle ‘weaknesses’ in the DB transfer market.

£7m SIPPs adviser is banned for 8 years

A Wolverhampton financial adviser has been banned for 8 years after clients lost £7m due to poor pension investment advice involving SIPPs.