Displaying items by tag: pension transfers

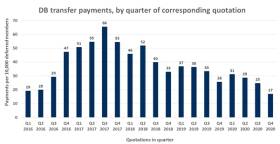

Contingent charge ban cuts pension transfers

The ban on contingent charging and the pandemic have resulted in a major slump in pension transfers, according to new research.

SIPP adviser shuts doors after complaints

Pension adviser Portal Financial Services LLP has shut its doors to new business following a string of complaints to the Financial Ombudsman Service, many brought recently by Claims Management Companies.

Concern over contingent charge DB transfers

Nearly 70% of DB transfers went ahead when contingent charging was used compared to less than 28% when non-contingent charging was applied, according to a Freedom of Information request.

Third of risky transfers slip through new pension rules

One in three high risk pension transfers since July 2018 would satisfy the first condition of the Department of Work and Pensions’ (DWP) proposed scam reduction legislation, according to a new report.

AJ Bell CEO warns against pension transfer 'safe list'

Andy Bell, CEO of platform and SIPP firm AJ Bell, has warned that proposed new anti-scam rules on pension transfers risk undermining thousands of legitimate transfers.

FCA takes legal action against DB transfer adviser

The FCA has begun civil proceeding in the High Court against Paul Steel for providing unsuitable defined benefit pension transfer advice.

It has also secured in interim injunction which freezes the assets of both Mr Steel and his partner Ms Foster up to the value of £7m, pending a further hearing.

The regulator said Mr Steel’s firm, Estate Matters Financial (in liquidation), contravened the Financial Services and Markets Act 2000 by providing unsuitable defined benefit pension transfer advice, leading consumers to exit defined benefit pension schemes when it was not in their best interests to do so.

The regulator added that Mr Steel, Estate Matters Financial’s director and co-owner, was knowingly concerned in the contravention.

The FCA alleges that Mr Steel breached FCA requirements by undertaking a course of conduct which resulted in the removal of the firm’s assets, leaving it unable to meet potential liabilities for unsuitable advice, while enabling him to retain the significant profits that accrued from the provision of the advice and from ongoing fees.

An injunction was also obtained against Ms Foster on the basis that she may be holding or controlling assets owned by her partner Mr Steel.

The FCA has also asked the Court to make a restitution order requiring Mr Steel to compensate consumers who have suffered losses as a result of receiving unsuitable pension transfer advice.

No trial date has been set.

Half of pension transfers now 'red flagged' - XPS

Over 50% of pension transfers covered by one pension firm’s scam protection service have been flagged up as at risk of a scam since the pandemic hit.

Nearly half of advisers could quit transfer market

Nearly half of financial advisers who currently offer pension transfers may quit the market in the next 12 months, new research has warned.

Pension transfer values bounce back in June

After an unsteady period, defined benefit (DB) pension transfer values increased to a record high during June and the number of members taking a transfer value rebounded strongly too.

TPR issues Covid-19 pension transfer warning

The Pensions Regulator has warned savers looking to transfer their pension pot during the Covid-19 outbreak that the move is “unlikely” to be in their best long term interests.