Displaying items by tag: pension transfers

FCA asks advisers about British Steel transfers

The Financial Conduct Authority has sent a survey to 2,500 advice firms on its work related to the British Steel Pension Scheme (BSPS).

Pensions consolidation on the rise

A third of Financial Planners have reported an increase in demand for pension consolidation advice over the past year, according to a new report.

BSPS victims may get FCA redress scheme

The FCA is to consult on launching a redress scheme for pension transfer victims of the British Steel Pension Scheme (BSPS) debacle.

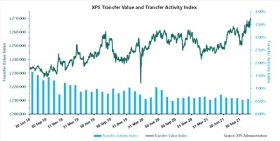

Transfer values climb but so do scam warnings

Retirement provider XPS Pension Group says its Pension Transfer Value Index climbed to a new high of £270,000 at the end of November due to forecasts of increased inflation and a dip in gilt yields.

BSPS claims top 1,000 as 5 more adviser firms fail

The Financial Services Compensation Scheme reported today that it has so far received 1,018 claims from former members of the British Steel Pension Scheme (BSPS).

Integrity IFA scolded by ombudsman for ignoring client complaints

The Financial Ombudsman Service (FOS) has upheld two complaints about Integrity IFA’s advice involving unregulated investments in SIPPs and scolded the advice firm for ignoring both clients and the ombudsman.

3 advisers behind £5.9m SIPP transfer scam face fines

The Financial Conduct Authority has warned two IFAs and a stockbroker that they face fines and regulatory action over their alleged role in a £5.9m SIPP pension transfer scam.

Pension transfer values hit new record

Pension transfer values briefly hit a new high in August as the FCA reviews potential redress for unsuitable transfer advice.

£125m pension transfer adviser appeals FCA fine

The FCA has provisionally fined pension transfer financial adviser Geoffrey Edward Armin £1.28m for a number of advice failings.