Displaying items by tag: pension scams

Martin Tilley: How education can tackle pension scams

The dark reality of pension scams is that we don’t really know how common they are. Fraud is a crime which tends to have low reporting events and with pension scams, it’s no different. The emotional toll can be as large as the financial, with some people being too embarrassed to report that they have been the victim of a scam.

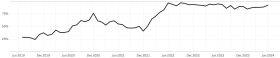

Pension scam warning flags at highest level for 9 months

Pension scam warning ‘flags’ have climbed to their highest level in nine months, according to a warning from pensions consulting and administration business XPS.

Pension scammers acting with impunity says industry body

Pension scammers are acting with impunity as few have ever been held to account, according to industry body The Pension Scams Industry Group (PSIG).

7.6m Britons targeted by pension scammers

Pension scammers have attempted to con 14% of the UK adult population, equivalent to 7.6m adults, a new study has found.

More than 100 join pension scam fightback drive

Nearly 120 pension schemes have signed up to back a campaign launched by The Pensions Regulator to do more to fight pensions scams.

Lisa Webster: QROPS in a post-Brexit world

I recently presented a technical webinar on pension transfers which included a look at transfers to qualifying recognised overseas pension schemes (QROPS).

Lisa Webster: Pension scams – what lies ahead?

Pension scams are not new but are growing in number and constantly evolving. Thankfully, after a slow start the wheels in motion to combat the scammers are starting to pick up speed.

5m pension savers 'at risk of scammers', say regulators

The FCA and The Pensions Regulator (TPR) are joining forces again this summer to warn the public about fraudsters targeting people’s retirement savings - as they revealed up to five million were at risk from scammers.

The alert came as new research suggested that 42% of pension savers, which would equate over five million people across the UK, could be at risk of falling for at least one of six common tactics used by pension scammers.

The likelihood of being drawn into one or more scams increased to 60% among those who said they were actively looking for ways to boost their retirement income.

Pension cold-calls, free pension reviews, claims of guaranteed high returns, exotic investments, time-limited offers and early access to cash before the age of 55 could all tempt savers into risking their retirement income, the regulators said.

The research also found that those who considered themselves smart or financially savvy were just as likely to be persuaded by these tactics as anyone else.

Pension savers were tempted by offers of high returns in investments such as overseas property, renewable energy bonds, forestry, storage units or biofuels.

However, exotic or unusual investments were described as “high-risk and unlikely to be suitable for pension savings”.

Nearly a quarter (23%) of the 45 to 65-year-olds questioned said they would be likely to pursue these exotic opportunities if offered to them.

Helping savers to access their pensions early also proved to be a persuasive scam tactic.

One in six (17%) 45 to 54-year-old pension savers said they would be interested in an offer from a company that claimed it could help them get early access to their pension.

However, accessing pension cash before 55 is likely to result in a large tax bill for the saver.

23% of all those surveyed said they would talk with a cold-caller that wanted to discuss their pension plans, despite the Government’s ban on pension cold-calls this January.

Nearly a quarter said they would ask for website details, request further information or find out what they were offering, even if the call came out of the blue.

Victims of pension fraud reported in 2018 that they had lost an average of £82,000.

The regulators issued a statement that read: “Pension fraud can be devastating, as victims can lose their life savings and be left facing retirement with limited income.

“As a result, the regulators are joining forces to urge pension savers to be ScamSmart and to check who they are dealing with before making any decision on their pension.

“Last year’s ScamSmart campaign resulted in more than 3,705 people being warned about unauthorised firms.

“This year’s campaign is currently running on TV, radio and online.”

Guy Opperman MP, Minister for Pensions and Financial Inclusion, said: “Pensions are one of the largest and most important investments we’ll ever make, and robbing someone of their retirement is nothing short of despicable.”

“We know we can beat these callous crooks, because getting the message out there does work.

“Last year’s pension scams awareness campaign prevented hundreds of people from losing as much as £34 million, and I’m backing this year’s effort to be bigger and better as we build a generation of savvy savers.”

Mark Steward, executive director of enforcement and market oversight at the FCA, said: “It doesn’t matter the size of your pension pot – scammers are after your savings.

“Get to know the warning signs, and before making any decision about your pension, be ScamSmart and check you are dealing with an FCA authorised firm.”

Nicola Parish, executive director of frontline regulation at TPR, said: “Scammers don’t care who they prey on or how many lives they wreck.

“If you ignore the warning signs you put yourself at risk of losing your savings.

“Victims are left devastated by what has happened to them.

“Make sure neither you nor any of your loved ones have to go through that ordeal.”