The FCA is proposing to retain a wider-scale public register of advisers and others working at financial services firms, it announced this morning.

Police have raided four homes and businesses as part of an investigation into “poorly-run pension schemes suspected of links to cold-calling”.

The founder of a SIPP firm has predicted ‘casualties’ within the Sipps market in coming months.

The run up to the end of the tax year can be a very busy time for advisers and is an ideal time to ensure that clients review their expression of wishes form. Trustees do have the discretion to select who will receive benefits, but will of course take account of any in an expression of wish form.

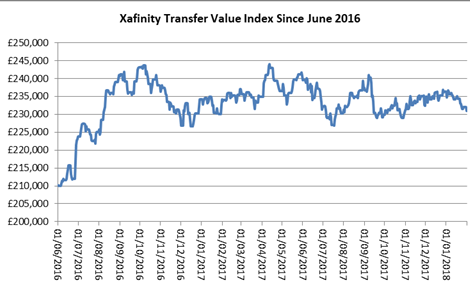

The latest figures on pension transfer values, released this morning, showed a fall last month.

The Xafinity Transfer Value Index fell steadily from £236,000 at the end of December to £231,000 at the end of January.

Sankar Mahalingham, head of DB growth at Xafinity Punter Southall, said: “Increases in gilt yields have been the main driver, with inflation remaining relatively stable.”

Graph below courtesy of Xafinity

Screen Shot 2018 02 12 at 09.38.10

The difference between maximum and minimum readings of the index over January 2018 was £6,000 or around 2.4%, Xafinity said in a statement.

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index.

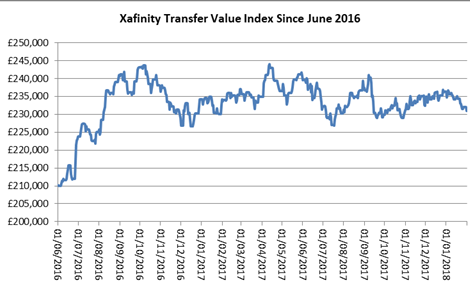

The Xafinity Transfer Value Index fell steadily from £236,000 at the end of December to £231,000 at the end of January.

Sankar Mahalingham, head of DB growth at Xafinity Punter Southall, said: “Increases in gilt yields have been the main driver, with inflation remaining relatively stable.”

Graph below courtesy of Xafinity

Screen Shot 2018 02 12 at 09.38.10

The difference between maximum and minimum readings of the index over January 2018 was £6,000 or around 2.4%, Xafinity said in a statement.

The Xafinity Transfer Value Index tracks the transfer value that would be provided by an example DB scheme to a member aged 64 who is currently entitled to a pension of £10,000 each year starting at age 65 (increasing each year in line with inflation).

Different schemes calculate transfer values in different ways. A given individual may therefore receive a transfer value from their scheme that is significantly different from that quoted by the Xafinity Transfer Value Index.

An ex-President of the Institute of Financial Planning has penned a new book showcasing ‘inspiring’ people aged 60 – 90 that demonstrate how to make the most of retirement.

More than 150 complaints have been lodged with The Pensions Ombudsman relating to the British Steel Pension Scheme.

An ex-adviser who turned client and says he lost £30,000 due to a pension transfer delay has been successful in his complaint against Intrinsic Financial Planning.

British Steel Pension Scheme trustees were urged to discuss “the importance of obtaining independent financial advice” with members, amid a major restructuring of the scheme, a report has revealed.

The FCA has launched a probe into possible ‘harm’ to consumers in the non-workplace pensions market.

News from Twitter

Articles by Keyword

AJ Bell

AMPS

annuities

Autoenrolment

Barnett Waddingham

Curtis Banks

DWP

FCA

FOS

FSCS

Hargreaves Lansdown

HMRC

James Hay

Lisa Webster

Mattioli Woods

Pension

pensions

pension transfers

Platforms

regulation

retirement

retirement planning

Sipp

Sipps

Ssas

The Pensions Regulator

TPR

Webster

websterblog

Xafinity